Supply Chain Concerns

Supply chain disruptions in the commercial cold-formed steel framing industry. By Don Allen

In February, the Cold-Formed Steel Engineers Institute asked me to speak about supply chain issues in the steel framing industry. In my talk, I expanded the scope to include resilience: I discussed how our employees, companies, communities, and world could better prepare for the next major event impacting our market. In this article, I will discuss what happened to our industry since late 2019, how the smart participants are responding, and a few strategies for preparing your workforce for the next major impact.

Construction is cyclic. Anyone who has studied the industry or been involved in construction for any length of time will tell you this. With our aging workforce, you don’t have to go too far to find someone who has been through a couple of downturns. I was born into the construction industry: my father formed Allen Construction Company a few years before I was born, and it went bankrupt when I was three. The ups and downs of the industry are not new but what we have seen over the past two years is different: many of us heard the word “unprecedented” more during 2020 than at any other time in our lives. We know that the root cause was the pandemic but what were the specific issues with construction materials?

During 2020, manufacturing shut down in many parts of the world. Closures were brief for some locations and industries; other areas and industries stayed closed longer. This was a supply-side issue: we knew construction was slowing but didn’t know how long or how deep the recession would be, so everyone hunkered down for the long haul. Families weren’t sure if they would be able to continue working. Many were furloughed or laid off and everyone who could, saved as much money (and toilet paper) as possible for an unknown future. Then governments did two things: they started giving money to people, and they declared several industries as “essential,” including construction.

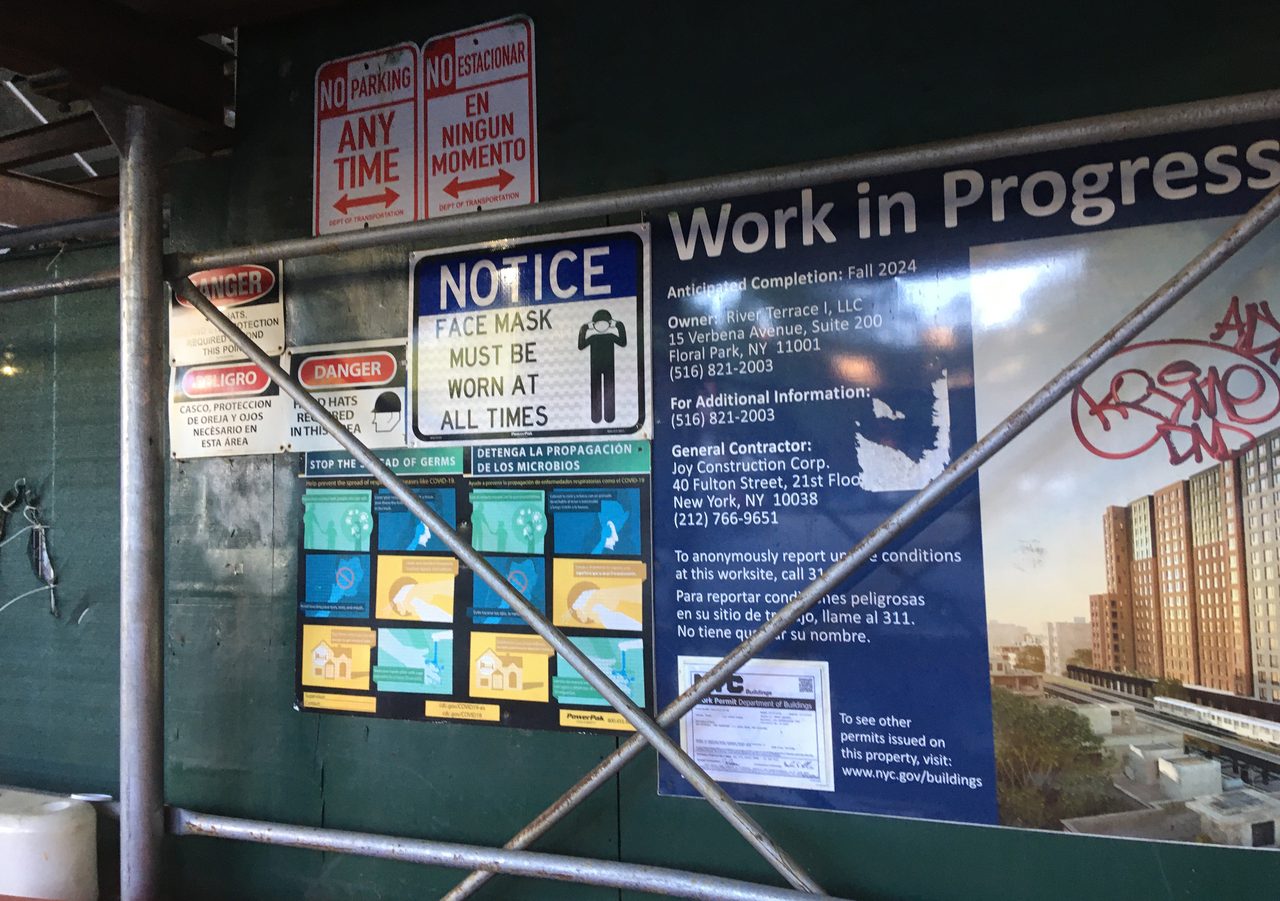

The money helped families feel better about spending, and the essential projects helped keep construction going. But once job sites opened back up, new problems came into play: how do you get workers to the 20th story of a high-rise jobsite with social distancing? Where do you get personal protective equipment for your entire staff when everyone else is trying to do the same? And with factories and sawmills still shut down, where do you get your construction materials?

Those Years

Twenty-twenty and 2021 saw all this happening, and once factories returned to full capacity, transportation became the significant bottleneck. Trucks, ships, even rail lines became clogged and the transportation industry was also reeling from staffing shortages: from drivers to the people that loaded and unloaded the cargo. Also, during this time, factories and sawmills were trying to fill orders, and customers who needed materials to keep their projects going were bidding up prices. Lumber yards were competing with pulp mills for logs. Automotive was competing with construction for steel.

From October 2019 to November 2021, steel mills announced price increases every month. During this time, the industry did what it could to increase capacity: but you cannot build or fire up a steel mill in a day. And mills have their own supply chain and worker issues. The good news for most hot steel mills is that they saw the need to automate decades ago, so not as many workers are needed to run the manufacturing of today. However, the skilled workers that are required were in short supply.

In addition to increased costs, as more buyers competed for the available products, lead times shot up. In markets such as New York City, where next-day or second-day delivery is the norm, lead times were over a month and longer depending upon the products needed. In areas such as the south, where the construction slowdown in many places was negligible early in the pandemic, construction sites were brought to a standstill because workers could not get the materials they needed. There was even one job in Mississippi where the drywall contractor was forced to install framing and wallboard before the building was dried in—just to show progress. As you may imagine, the results were disastrous, and much of the installed product had to be removed or remediated because of moisture issues.

Is Bigger Better?

The bigger projects have been able to secure materials and, in some cases, have helped lead to material shortages. Anyone trying to get open-web bar joists knows this: warehouse construction boomed during the pandemic, and in some places, lead times for these products were up to 18 months. During 2020, more than 190,000,000 square feet of warehouse space was under construction in North America. Amazon alone built 250 new warehouse facilities in 2021.

Specific to steel, new domestic capacity is in process, and some of the manufacturing plants have already opened. After years of dumping low-priced overseas steel, in particular from China, the protections afforded by the Section 232 tariffs have allowed several domestic steel companies to return to profitability and invest in domestic mills. Plants in Gallatin County, Kentucky, and Sinton, Texas that have started construction over the last few months, have a combined annual capacity of over one million tons. In February, U.S. Steel started construction on a new facility in Arkansas that will have an annual capacity of three million tons.

Since these plants are all domestic, the supply issues with overseas shipping, unstable governments, and tariffs will have a reduced effect on the steel supply in North America in the future. However, international impacts are never entirely eliminated: markets for scrap and iron ore are global, so these commodities will still affect domestic steel mills.

The good news is that the U.S. economic outlook is still strong. Despite inflation pressures, most economists see the economy in general and construction, in particular, continuing to do well. One good thing that has come out of the longer lead times is that producers and supply yards have started to catch up, and have increased their on-hand inventories as a cushion against similar shortages in the future. Visiting supply-yard customers during 2019, it was not unusual to see the distributors’ yards mostly empty, with very little stock on hand and just-in-time or manufacturer-to-jobsite delivery of products. Now, distributors have stocked up. Although there are still spot shortages on specific thicknesses, most of the high-volume items are available, and lead times for these items are only slightly above pre-pandemic levels.

Still, don’t expect prices of materials to drop significantly anytime soon. Now that auto manufacturers are able to get microchips, their steel demands will increase. Some investors in canceled or delayed construction projects were taking a “wait and see” position but realized that they might as well build now. This caused demand to remain strong. And several designers, looking for alternatives to bar joists or engineered wood, have found that cold-formed joists make an excellent substitution.

There are a couple of significant drivers of the world economy that the U.S. and other construction markets will feel for the next few years. First is the push towards reduced carbon emissions, and second is the trend towards automation in construction.

The recent infrastructure bill differs from similar past bills in two key areas: its size and emphasis on carbon-reducing technology. The making of concrete, steel, and lumber all have major environmental impacts that architects and owners are starting to consider more in their designs. Manufacturing industries also realize the impacts of their products and are developing more sustainable ways to produce their products and use them in construction. Engineers play a vital role in plant design, product development, and building design in ways that reduce energy use and reduce the carbon footprint of the building.

As an industry, we have already seen specification requirements for reduced cement in concrete and high recycled content in steel, and sustainably harvested wood. Still, in the not too distant future, we will see specifications for green steel and concrete, as many consumers demand net-zero emissions on their buildings and transportation systems.

Hard Labor

The other impact that most of us are aware of is labor. With the “great retirement,” we have seen some of the seasoned veterans of our industry leave the workforce, and recruiting new skilled workers in construction has been difficult at best. Many framing companies and manufacturers see part of the solution as better training and improved immigration policy, but the most significant opportunities are in automation and prefabrication.

In the 1990s, most prefabrication and panelization plants lasted only a few months or years. But now, companies are integrating new technologies into their prefabrication processes that allow more offsite construction to take place, leading to fewer weather delays and less demand for highly skilled workers. Factory workers require less training and supervision than skilled jobsite labor, and quality control allows mistakes and glitches in the plant to be caught sooner than typical field issues.

Jobsite technology and automation are already making a difference in projects and products. The need for social distancing gave a big push to the use of drones and labor-reducing jobsite technology. Many inspections are now done using drones. Technology for taking BIM into the field with augmented reality and layout tools is creating significant reductions in the time and staffing needed in the field. I have seen demonstrations of robots that can finish drywall and others that can layout wall locations on a slab. In the past, these technologies were too expensive or too fragile for the extremes of typical job sites, but labor shortages and costs have helped make these more attractive options.

Realizing the potential, companies like Trimble that have already been supplying construction technology for decades, are rapidly bringing these advances to the field. Forward-thinking companies are already deploying these technologies on select projects.

With the long-term effects of the current pandemic still to be determined, the question is: how do we prepare? As always with construction: the keys are to build up cash during the good times in preparation for difficult times, have a flexible and lean workforce, invest in technology where it makes sense, and constantly assess corporate planning and decision making. Partnering in both directions—with customers and suppliers—is essential for long-term stability.

Images courtesy of Super Stud Building Products.

Don Allen, P.E., LEED A.P. is an internationally known expert in cold-formed steel design, and currently serves as director of engineering for Super Stud Building Products. He chairs the Education Committee of the American Iron and Steel Institute, is actively involved in the development of ASTM and AISI standards, and has designed projects in Europe, Africa, and North America. In addition to working for steel product manufacturers, Allen has spent more than a decade in private practice and served over nine years as technical director for the Steel Stud Manufacturers Association, the Steel Framing Alliance and the Cold-Formed Steel Engineers Institute.