Trade News

U.S. Ceilings Market Forecast 2024-2033: Commercial Building Rebound Fuels Growth

This industry study analyzes the $2.5 billion U.S. ceilings industry. It presents historical demand data (2013, 2018 and 2023) and forecasts (2028 and 2033) by product (ceiling tiles, suspension systems and specialty products) and market (residential and nonresidential).

Annual historical data and forecasts are also provided from 2020 to 2027. The study also evaluates company market share and competitive analysis on industry competitors, including Armstrong World Industries, Knauf (USG), Saint-Gobain (CertainTeed) and ROCKWOOL (Rockfon).

U.S. demand for ceiling products is forecast to rise 2.1 percent per year to $2.7 billion, reaching 1.6 billion square feet in 2028. This rate of growth will represent a deceleration as ceiling product prices moderate from a high base caused by supply chain disruptions and high raw material costs.

Growth will be derived from a rebound in area demand as:

- Commercial building construction improves following a poor pandemic-related performance.

- Increasing concerns over aesthetics and sound control in building spaces encourage the use of ceiling products in structures that did not previously have them.

Market value will be supported by the increasing use of higher-value products, such as high noise reduction coefficient tile and tiles made from metal or wood.

The commercial building market—by far the larger of the two ceiling product markets—will drive demand gains as commercial building construction improves after pandemic-related weakness.

- Office construction will increase as employees continue to return to offices full-time or in a hybrid format. For building owners with vacancies, renovations—including the replacement or installation of ceiling products—will allow them to compete in what has remained a difficult market for existing office space.

- The construction of hotels and other types of lodging will rise as travel and tourism surpass pre-pandemic levels. Market value for ceilings will also be supported by the increasing use of higher-value ceiling products, such as wood or metal tile, to impart an upscale aesthetic to attract customers.

- Health care construction will be boosted by an increase in medical care, due in part to the large aging population in the U.S. Many healthcare facilities also rely on higher-quality, costlier ceiling products that help to reduce noise transmission between rooms and reverberation time within rooms to improve speech intelligibility.

The popularity of open-plenum (or open-deck) design has served as a restraint on ceiling products, specifically ceiling tiles and suspension systems. This design trend has moved from factories and warehouses—where cost and performance dictated its usage—to a variety of commercial buildings and residential structures due to its industrial aesthetic and its functionality (e.g., greater air circulation) that have led some to prefer it to either ceiling tiles or drywall.

However, open-plenum design does offer opportunities for some ceiling products, primarily clouds and baffles. These products are able to improve the acoustics in a space that uses open-plenum design, an important feature for restaurants, offices or lobbies. They can also impart a different, and perhaps more desirable, aesthetic from structures where the upper areas have been left exposed.

The ceilings market is cyclical due to its close relationship to building construction activity, which is in itself cyclical. However, renovation activity is generally less volatile than new building construction, which helps to moderate demand swings, save for the most severe contractions in construction activity.

U.S. ceiling product demand is heavily influenced by trends in commercial building construction, as this market accounted for 88 percent of all U.S. ceiling demand in value terms in 2023. In residential applications, ceiling construction is dominated by drywall and plaster ceilings, which are excluded from the scope of this report.

Other factors that impact volume demand and market value for ceilings on a year-to-year basis include raw material prices, residential renovation activity and building design trends, especially in the commercial sector, where the look of ceilings is an important design component in markets like restaurants and lodging establishments.

In area terms, demand grew at a steady pace until the onset of the COVID-19 pandemic, which had a severe impact on commercial building construction and renovation and caused demand to decline from 2020 and 2022.

Through 2028, demand for ceiling products is forecast to reach $2.7 billion with an annual growth of 2.1 percent. While growth in value terms will decelerate following the elevated price increases of the 2018-2023 period, demand will be supported by the ongoing shift toward higher-value products. Meanwhile, growth in area terms is expected to rebound, driven by increasing commercial building construction as the effects of the COVID-19 pandemic continue to recede.

The commercial market dominates demand for ceiling products because:

- Grid and tile systems are more commonly used in commercial buildings than residential ones.

- Commercial buildings more often feature high-value specialty products, such as clouds or baffles, to dampen sound and add aesthetic appeal when the building has an open ceiling plan.

In the residential market, by contrast, drywall remains the dominant ceiling covering; specialty products are often too costly and impractical to use.

The residential ceiling market will decelerate significantly through 2028, restrained by a moderation in metal and wood tile prices, a slowdown in new housing, relatively slow growth in renovation activity and a decline in new housing completions. The commercial ceiling market will continue to be driven by rising construction and renovation of offices, institutional facilities and high-end hotels.

Pricing for ceiling products is impacted by a variety of factors, including energy costs, transportation costs and product availability, which can be affected by labor shortages and delays in production schedules.

Ceiling product prices are also affected by changes in the cost of raw materials, such as metals, mineral fiber, wood, fiberglass and plastics. Although increases in raw material prices are often passed along to consumers, ceiling manufacturers work to reduce these costs through either improved production technologies or low-cost material sourcing.

After a period of relative stability, a combination of supply chain disruptions and inflationary pressures caused a sharp increase in the cost of key materials, such as mineral wool, metal, perlite and wood, starting in 2021, which in turn caused ceiling prices to surge at a double-digit rate. Prices grew rapidly again in 2022 as these issues continued to affect the industry. However, price growth slowed significantly in 2023 as supply chain issues eased and raw material costs moderated.

Through 2028, prices for ceiling products will either see growth decelerate from the 2018-2023 period or experience an outright decline.

- Average prices for ceiling tiles are projected to decline, due in part to a drop in prices for raw materials for mineral-fiber ceiling tiles. Moderating raw material costs will also impact metal and wood ceiling tiles.

- Prices for clouds will be impacted by moderating metal prices.

Top Economist for Cement and Concrete Industries Reveals 2025 Construction Forecast

Ed Sullivan, chief economist and senior vice president of market intelligence for the Portland Cement Association—which represents America’s cement manufacturers—says that the Federal Reserve’s recent move to lower interest rates, coupled with easing inflation, signals a significant retreat in interest rate levels by the end of next year…all to the benefit of construction activity.

At PCA’s annual Fall Meeting held in Colorado in October, Sullivan shared the industry’s economic forecast for 2025 with cement company leaders. Key points highlighted include:

- It will take time for the impact of the Fed’s policy pivot to materialize in the economy and construction. Near-term, construction activity is expected to be burdened by oppressively high interest rates. As more rate cuts transpire, construction loan rates are expected to decline—spurring new life into the construction market. This is expected to begin by mid-2025.

- Mortgage interest rates are expected to decline to 5.5 percent by mid-2025 and 5 percent by year-end 2025. This is likely to usher in favorable home affordability and a surge in consumer demand.

- Lower rates will also usher in a significant increase in the supply of existing homes on the market. This is expected to more than offset the increase in demand and lead to a reduction in new and existing home prices. This further enhances affordability.

- Nonresidential construction will also benefit from lower interest rates. Unfortunately, it will take time to improve occupancy rates and increase Net Operating Income. These will come as the economy gains momentum next year. Given this, nonresidential construction is not expected to see recovery until 2026.

- Public construction activity is expected to benefit from increased spending associated with the Bipartisan Infrastructure Law.

DOL Funds Opportunities for Women in Apprenticeships and Nontraditional Jobs

The Department of Labor announced the award of $6 million in funding to help recruit, train and retain more women in quality pre-apprenticeship and Registered Apprenticeship programs, as well as nontraditional occupations. The funding—distributed through Women in Apprenticeship and Nontraditional Occupations grants—will enable organizations in eight states and the District of Columbia to provide training programs in skilled building trades, advanced manufacturing and information technology.

WANTO grants provide technical assistance to support women’s participation in fields where they are traditionally underrepresented, such as construction, advanced manufacturing, energy, technology and transportation. Grant recipients can use a portion of their funding to support services, such as childcare, transportation, tuition and work-related gear. The full list of funding recipients is available.

What to Know About Code Changes for Masonry Veneer

In a game-changing move, changes have been made to masonry codes to introduce new options for designing and constructing adhered masonry veneers that will have a significant impact on how products are used and installed.

As the industry gears up for changes in codes and standards for adhered masonry veneer, manufacturers are preparing. According to Nick Lang, vice president of engineering for masonry at the Concrete Masonry & Hardscapes Association, as masonry technology and material manufacturing continue to evolve, the industry’s installation and performance standards are changing with it.

“With these changes in the 2022 version of TMS 402 and 602, which is referenced in the 2024 International Building Code and International Residential Code, local jurisdictions will begin the process to adopt these codes soon, but having information out there ahead of the codes is important for preparedness,” Lang said. “We have task groups working on manufactured stone veneer technical resources, which will be followed by education.”

Until then, here is a breakdown of the updates needed to stay ahead of the curve.

There will be two approved approaches for designing masonry veneer walls: prescriptive, which are basic, off-the-shelf standards, and engineered, which are very specific to an engineer or architect’s customized job needs.

- Prescriptive Approach: This is the “do it like this” method, where installations complying with specific conditions are good to go. The big changes here are in the limits and conditions set under TMS 402/602-22. What is discussed below applies to the prescriptive approach.

- Engineered Method: This leaves the approach up to the design engineer, with less control and limits over installation. This innovative path is perfect for unique or challenging applications. It mandates an engineer’s expertise to craft the design. Provided the engineer has done their homework, they may spec what they please.

Prescriptive Approach: More Freedom, Better Results and Key Changes

For the prescriptive approach, several modifications have taken place that actually provide more design freedom for design and architectural pros using masonry. It’s important to know these changes, even though they may not be fully adopted at the state level until 2025. These are the largest impact areas and model codes already in the works:

- Adhered Veneers: Veneers must be manufactured units, such as manufactured stone veneer units.

- Adhered Veneer Maximum Weight: Weight per unit is increasing from 15 pounds per square foot to 30 pounds per square foot. With the permitted unit weight now approved for up to 30 pounds per square foot, this will allow for more flexibility in design.

- Setting Bed Mortar: Use of ANSI A118.4 or A118.15 polymer-modified mortars are now required for enhanced bond strength for adhered veneers.

- Veneer Orientation: Veneers must be installed vertically, aligning with prescriptive detailing requirements.

- Veneer Height: Above grade is limited to 60 feet, striking a balance between design freedom and practicality. This presents an opportunity for architects and adhered veneer manufacturers, providing more wall space for veneer products.

- Deflection: Deflection of backing is limited to ensure sturdiness in the face of wind and seismic loads.

- Assembly Weight: The assembly weight is now the focus for prescriptive design, allowing for adhered veneers with rigid insulation.

- Assembly Thickness: The total assembly thickness is limited to 4 5/8 inches for better performance and design considerations.

- Permitted Unit Area: Single-unit surface areas can’t exceed 5 square feet, and approved installation procedures are now needed for units exceeding 2.5 square feet. This keeps installation quality paramount. Previous requirements on unit length or width have been removed, allowing for more freedom in unit design.

One caveat on wall height that Lang pointed out is that it does depend on the substrate. “Light-frame structural backups would still have longstanding veneer height limitations of 30 feet, and once you exceed that, the system needs to be designed and detailed properly,” he said.

For workers and specifiers, the need for polymer-modified mortars comes with increased weight allowances and wall space. Another caveat, Lang said, is that masonry professionals may also need to enhance fasteners, especially with extensive amounts of continuous insulation. The new prescriptive provisions in the code have expanded fastener tables that take into account veneer weight, cavity width and fastener spacing.

How does Lang anticipate the transition? “Simplifying the standard unit area to a square-footage requirement will make the transition easier and simpler to apply than the current standard,” he said. “In addition, crews familiar with code-compliant installations are in for a smooth transition, with only minor adjustments, like using polymer-modified setting mortars.”

Lang said it’s also likely that existing product certifications will still hold their ground. “It’s important to remember that change can be part of innovation and opportunity,” he said. “As the industry requirements and product technologies evolve, changes in codes and standards are actually allowing more design freedom and better safety to move the industry forward.”

https://www.wconline.com/articles/96682-what-to-know-about-code-changes-for-masonry-veneer

Skilled Trades Advisory Council Earns Nonprofit Status to Address Labor Crisis

The Skilled Trades Advisory Council announced that it has officially earned 501(c)(3) nonprofit status, a significant milestone in its mission to combat the ongoing skilled labor crisis in the United States and Canada. Founded in August 2023, STAC brings together industry leaders who are leveraging their resources, expertise and networks to promote skilled trades as high-paying, honorable and essential career paths. These trades include electrical, plumbing, HVAC, janitorial, construction and other critical sectors in need of a rejuvenated workforce.

“As the demand for skilled trades continues to outpace supply, the work of STAC has never been more critical,” said Rob Almond, CEO of NEST and founding advisor of STAC. “Achieving nonprofit status empowers us to further our mission, create meaningful partnerships, and drive initiatives that will elevate these careers and ensure the future of our workforce.”

In its first year, STAC has made significant strides in elevating the conversation around skilled trades. The organization has successfully advocated for the importance of these careers and united industry leaders to drive change. Key achievements include collaborations with high-profile advocates like Mike Rowe, skilled trades programming with the Philadelphia Phillies and alliances with leading organizations, such as Explore the Trades, Women in HVACR, NAWIC Philadelphia Foundation, SPECS and CONNEX FM.

The urgency for skilled trades careers is underscored by a report from Associated Builders and Contractors, which indicates that the construction industry alone will need to hire an additional 500,000 workers in 2024 to meet labor demands.

Founding STAC advisors include:

- Almond

- Andrew Brown, founder and CEO of Toolfetch

- Kate Cinnamo, executive director of Explore the Trades

- Mary Gaffney, president of NAWIC Philadelphia Foundation and GEM Mechanical Services

- Sarah Hammond, owner and president of Atlas and treasurer of Women in HVACR

- Mónica Muñoz, senior director of capital programs at DaVita Kidney Care

- Julie Starzynski, design and development manager at BP

- Sara Angus, director of construction at Starbucks

- Kam Washington, owner of PMA Construction

EIFS Excellence Awards Program Unveils New Judging Criteria

The competition for the prestigious 2024 EIFS Excellence Awards is underway. Previously known as the EIFS Hero Awards, this esteemed program highlights outstanding projects within the EIFS industry across various building categories.

EIMA announced new, formalized judging criteria as part of the program’s ongoing enhancements. Each project will undergo a detailed evaluation, based on a comprehensive set of standards, to ensure that every aspect of the EIFS project is thoroughly reviewed. The judging criteria are:

Aesthetic Appeal and Design Integration - 25 Percent of Overall Score

- Visual Excellence: Demonstrates superior aesthetic qualities, contributing to the overall visual appeal and architectural beauty of the structure.

- Design Harmony: Showcases how EIFS seamlessly integrates with various architectural styles, enhancing the building’s design without compromising the original architectural intent.

Innovation and Creativity - 25 Percent of Overall Score

- Cutting-Edge Solutions: Highlights the use of innovative techniques, materials or applications within the EIFS framework that push the boundaries of traditional usage.

Challenges and Resolutions - 20 Percent of Overall Score

- Creative Problem-Solving: Demonstrates how EIFS was used to address unique challenges or meet specific project requirements in an exceptional way.

Functionality and Performance - 20 Percent of Overall Score

- Energy Efficiency: Demonstrates the role of EIFS in improving the building’s thermal performance, contributing to energy savings and sustainability.

- Durability and Maintenance: Provides evidence of the long-term durability of EIFS in various environments, showcasing minimal maintenance requirements and resilience against wear and tear.

Submission Presentation - 10 Percent of Overall Score

- Quality of the submission’s narrative and photography.

The evolution of the awards program is a testament to the dedicated efforts of EIMA’s promotion working group and awards task force, whose innovative ideas and hard work have significantly shaped its development.

For any questions or further information, contact EIMA program manager Aggie Sterrett at asterrett@eima.com.

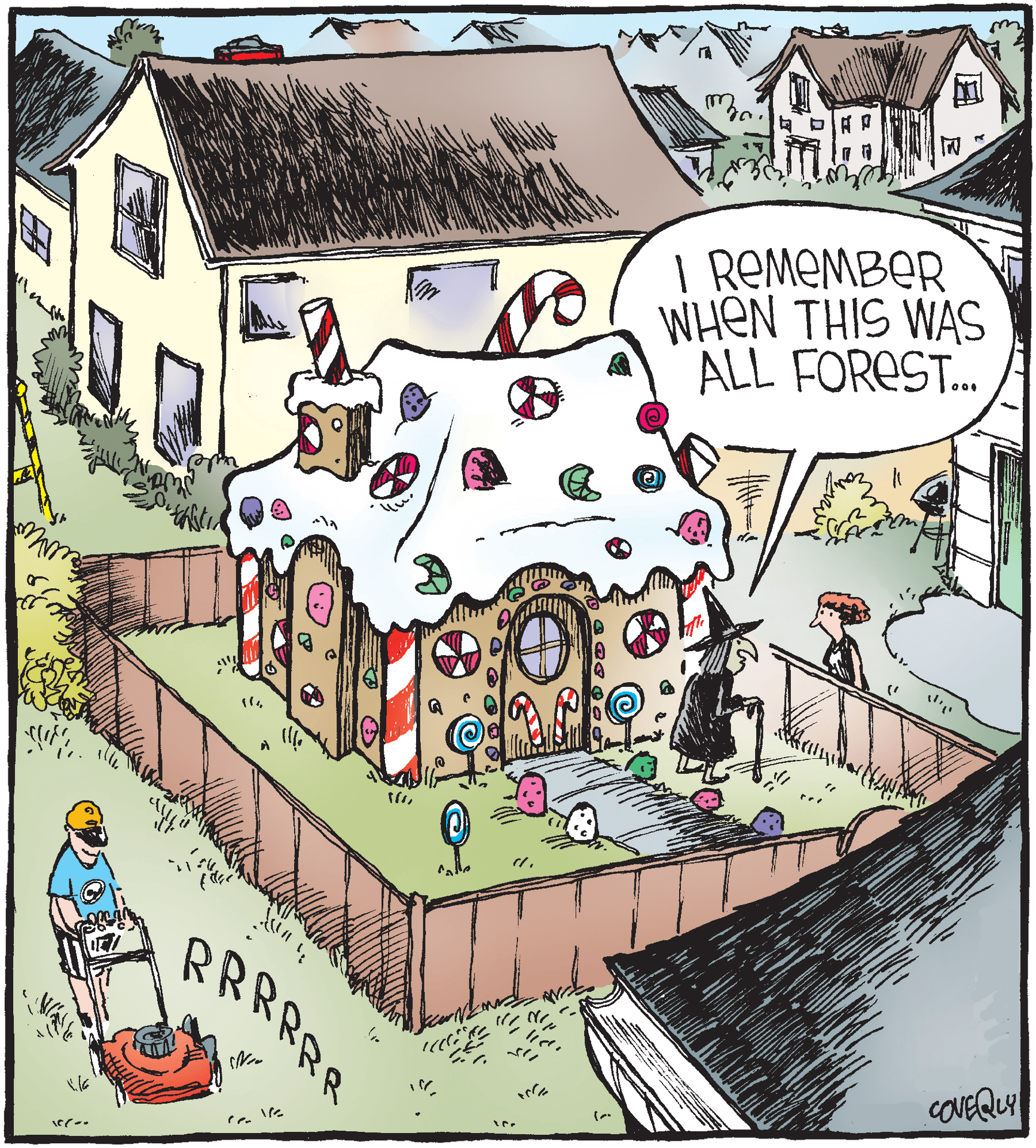

Spackle by Dave Coverly

People News

The Lester Group appointed Jerry Pennington as vice president of Fortress Door Company. The company also hired Thomas Hartman as general manager of Custom Builder Supply.

Hartman

Pennington

BuildBlock announced that Russ Nicely has joined the company as commercial development director. The company also hired Frank Gordon as vice president for strategic development.

Gordon

Nicely

The American Chemistry Council’s Center for the Polyurethanes Industry named Lisa Massaro-Kustuch as the recipient of the 2024 Distinguished Leadership Award.

The Steel Bridge Task Force named David Stoddard as the recipient of the 2024 Alexander D. Wilson Memorial Award.

SMACNA appointed Tom Martin as its 2024-2025 president. Four members were also named to new roles on SMACNA’s executive committee: Todd Hill as president-elect, Scott Vidimos as secretary-treasurer, Joseph Samia as vice president and Carol Duncan as immediate past president.

The Steel Framing Industry Association announced that Jay Larson, P.E., F.ASCE, formerly with the American Iron and Steel Institute, has been appointed secretariat of the newly formed SFIA Standards Committee.

Obituary

Renee Ann Conrad Cieslikowski, 70, of Lake Wylie, S.C., passed away peacefully this October in Charlotte, with her husband Mark by her side. Many Walls & Ceilings readers knew her through her lengthy tenure at National Gypsum as its marketing manager before her retirement several years ago.

Renee and Mark moved to Charlotte in 1978 as her employer, National Gypsum, relocated its headquarters from Buffalo. From Senior Stenographer to Creative and Marketing Director of the company, she excelled in managing the production of technical and marketing literature, advertising, and pulling together the company’s first consumer-facing campaign, the PURPLE family of products. Her diligence and focus on client relationships garnered her projects numerous advertising awards and she received the 2013 President’s Excellence Award at National Gypsum. One of her proudest accomplishments was completing her college education and receiving her BS in Business from Pfeiffer University.

Together with their dear friends, Brian and Linda Rich, Renee and Mark formed the Q2U BBQ team. They later opened a restaurant in Lake Wylie known for their award-winning BBQ, catering and community involvement. This BBQ was shared with W&C and many drywall subcontractors in 2012, when National Gypsum held a plant tour and contractor roundtable at the company’s Mt. Holly facility in North Carolina (see the cover article “A Dialogue in Process,” W&C June 2012).

W&C considered Renee a great friend and a hard worker, with a great personality always willing to help answer questions, provide editorial assistance and partner with the magazine on special projects. We as a team are saddened to hear of her death.

Renee Ann Conrad Cieslikowski, 70, of Lake Wylie, S.C., passed away peacefully this October in Charlotte, with her husband Mark by her side. Many Walls & Ceilings readers knew her through her lengthy tenure at National Gypsum as its marketing manager before her retirement several years ago.

Renee and Mark moved to Charlotte in 1978 as her employer, National Gypsum, relocated its headquarters from Buffalo. From Senior Stenographer to Creative and Marketing Director of the company, she excelled in managing the production of technical and marketing literature, advertising, and pulling together the company’s first consumer-facing campaign, the PURPLE family of products. Her diligence and focus on client relationships garnered her projects numerous advertising awards and she received the 2013 President’s Excellence Award at National Gypsum. One of her proudest accomplishments was completing her college education and receiving her BS in Business from Pfeiffer University.

Together with their dear friends, Brian and Linda Rich, Renee and Mark formed the Q2U BBQ team. They later opened a restaurant in Lake Wylie known for their award-winning BBQ, catering and community involvement. This BBQ was shared with W&C and many drywall subcontractors in 2012, when National Gypsum held a plant tour and contractor roundtable at the company’s Mt. Holly facility in North Carolina (see the cover article “A Dialogue in Process,” W&C June 2012).

W&C considered Renee a great friend and a hard worker, with a great personality always willing to help answer questions, provide editorial assistance and partner with the magazine on special projects. We as a team are saddened to hear of her death.