As contractors anticipate a surge in prefabrication over the next five years, this article breaks down how to evaluate its financial viability, balance risks, and build a compelling case for investment. By Tyler Paré

Underwriting Prefabrication:

Is the Juice Worth the Squeeze?

xxxxx. xxx

xxxxx

xxxxxxxxx

xxxxxxxxxxxxxxx By xxxxxxxx

h2 - xxxx

h3 - xxxx

H1 headline

On average, contractors expect their prefabrication labor hours to double in the next five years, according to FMI’s 2024 Labor Productivity Study Part 2: Prefabrication. While that’s an ambitious and exciting outlook, it won’t become a reality without significant investment and organizational commitment to developing prefabrication capabilities.

In the volatile, low-margin world of construction, big bets on the future can be daunting. Limited capital and workforce availability often make contractors hesitant to invest heavily in prefabrication. So, how do you right-size that investment? If you needed to justify a prefabrication expansion to your board or executive team, what would that business case look like?

Viewed through a purely financial lens:

- Is increasing the percentage of prefabricated work accretive to earnings?

- Does the economic case only work if prefabrication also enables broader enterprise growth?

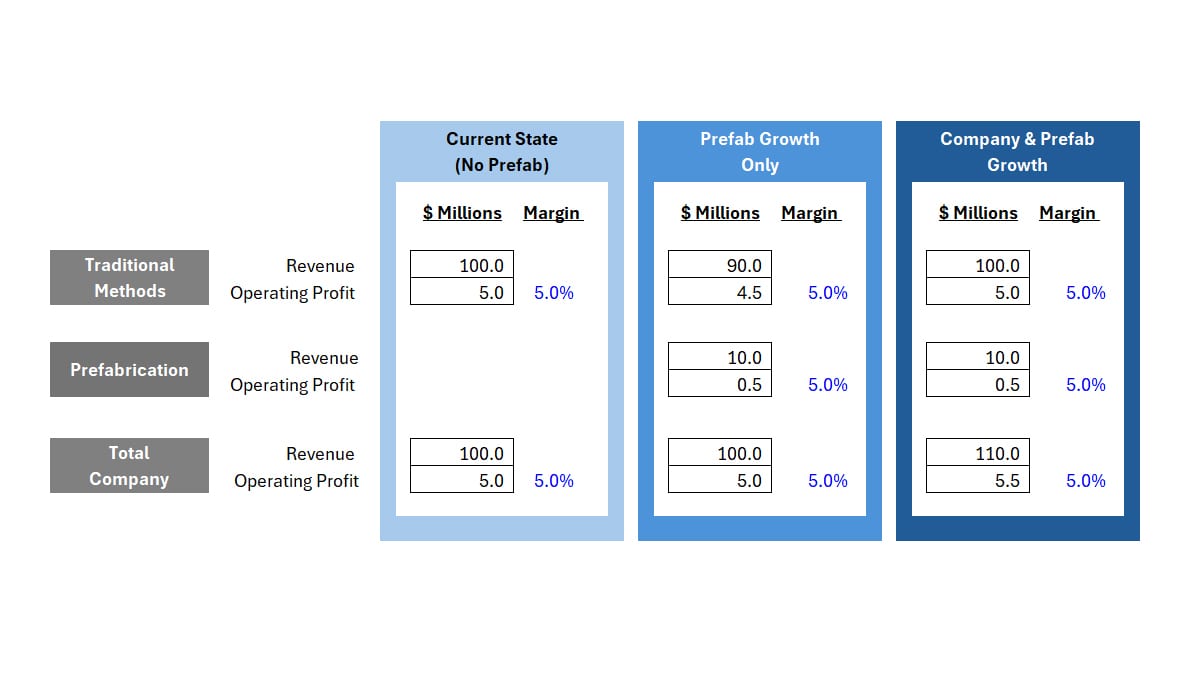

To answer those questions, we need to compare the economics of traditional installation methods versus prefabrication at the operating profit margin level. Prefabrication may yield lower direct costs and higher gross margins, but often comes with increased operating expenses—think facilities, equipment, and logistics. That’s why operating profit margin becomes the most relevant comparison metric.

Let’s explore two high-level scenarios:

Scenario 1: No Material Difference in Operating Margins

Even if operating margins on prefabricated work are comparable to traditional methods, there are still strong reasons to pursue it:

Prefabrication Growth Alone

While earnings may be equal, prefabrication offers more control over safety, schedule, and quality—effectively lowering the business’s overall risk profile. That makes the “risk-adjusted” earnings more attractive.

Prefabrication + Enterprise Growth

Prefabrication can free up your most experienced field installers and leaders by offloading basic, repetitive tasks. This capacity gain enables you to take on more work without proportional increases in skilled labor. The same result can be achieved through outsourcing prefabrication—assuming costs are comparable.

Moreover, having in-house prefabrication capabilities may make your firm more appealing to owners and general contractors who prioritize prefab-enabled delivery. In short, it can open doors to projects you might otherwise miss.

Scenario 2: Higher Operating Margins from Prefabrication

If prefabricated work delivers “higher” margins than traditional methods, the value proposition becomes even more compelling. But even then, sizing the opportunity and quantifying its impact is essential.

For instance, if prefabrication could boost annual operating profit by $1 million, that’s a clear motivator. What follows are key diligence questions:

- Can we isolate prefab shop earnings from field installation to measure true impact?

- What level of investment is needed, and over what timeline?

- What’s the anticipated return on investment?

- Will our current or projected workload support this scale of prefabrication?

- What shifts in strategy, business development, preconstruction, or design are needed to win the right kind of work?

- What internal hurdles—cultural, procedural, or otherwise—must we overcome?

These are valid, foundational questions that need answers before launching a major prefabrication strategy. But it starts with sizing the economic opportunity. That analysis provides the springboard for deeper, more focused conversations on how to underwrite a successful prefabrication growth plan.

Opening Image Credit: anatoliycherkas / iStock / Getty Images Plus via Getty Images.

Chart graphic courtesy of FMI

Tyler Paré leads FMI’s Performance practice, which helps contractors optimize profitability and manage risks. His team advises clients on the major drivers of contractor performance—estimating and preconstruction services, project management and field leadership, operational excellence, field labor productivity, fleet management, financial and risk management, and compensation and reward structures. As a consultant with FMI, Paré leverages his industry experience and business intellect to help contractor clients improve their business operations and grow profits. He also facilitates contractor executive peer groups, which bring construction industry leaders together to collaborate and learn from each other.