Trent Cotney and Brian Lambert

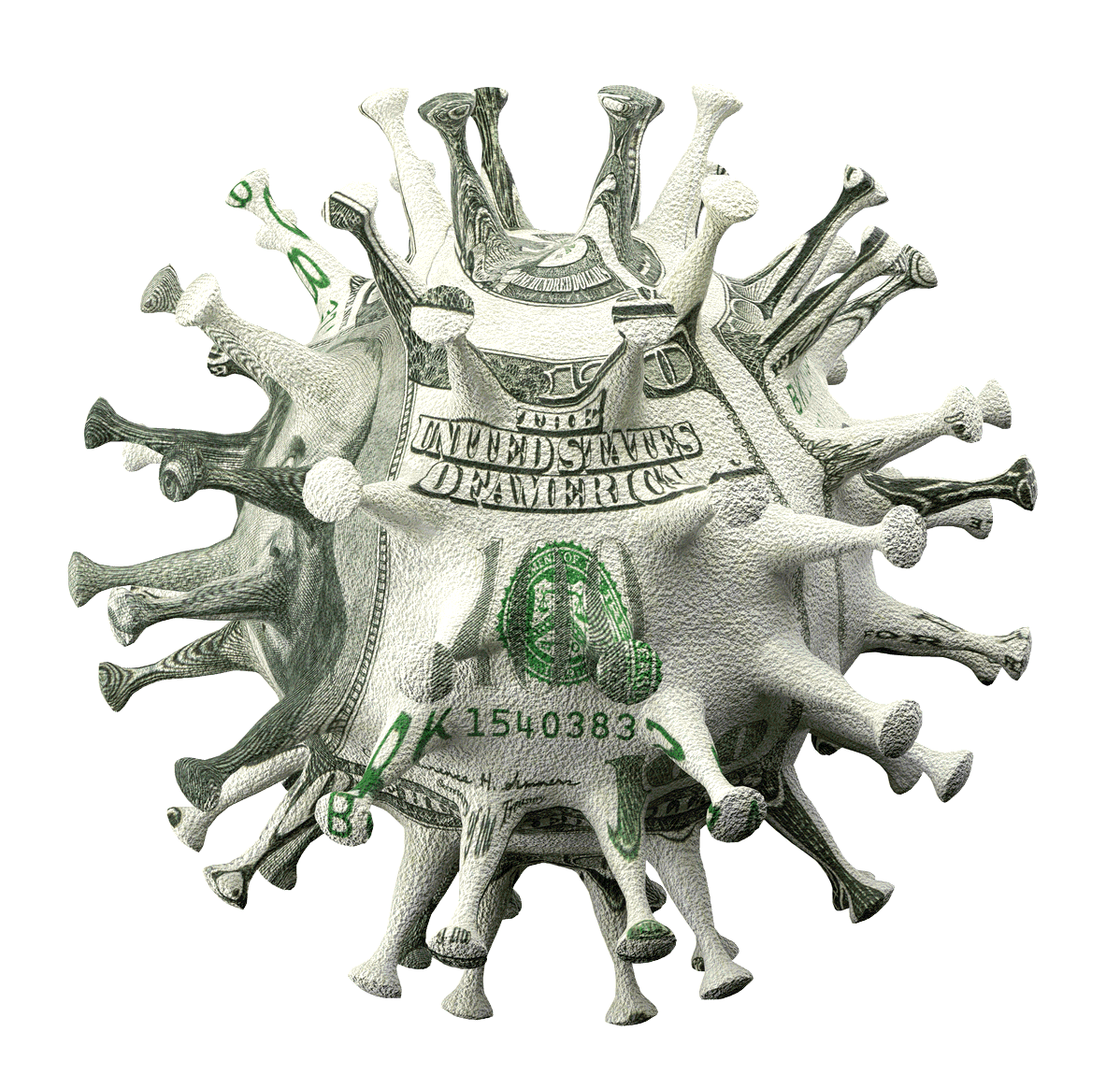

The Consolidated Appropriations Act Explained

Everything you wanted to know about the Consolidated Appropriations Act and more.

Trent Cotney and Brian Lambert

INDUSTRY VOICES

As 2020 drew to a close, the U.S. Congress passed the Consolidated Appropriations Act, 2021, a massive $900 million coronavirus relief bill combined with a $1.4 trillion omnibus spending bill. Totaling $2.3 trillion and nearly 6,000 pages, it was one of the largest spending measures and according to the Senate Historical Office, the longest piece of legislation in U.S. history.

The U.S. House and Senate passed the bill in December and President Trump signed it on December 27. The omnibus spending bill covered the balance of the federal government’s fiscal year, which ends September 30, 2021; the relief bill addressed the challenges the nation has been facing during the pandemic. While the news media has focused mostly on the size of the relief checks included in the package, several provisions will impact the construction industry.

Small Business Provisions

The relief bill brings good news to small businesses. It has extended the Paycheck Protection Program through March 31, 2021 and permits a second round of PPP loans. However, this round is intended only for companies with fewer than 300 employees that can show evidence of at least a 25 percent loss of gross receipts in any 2020 quarter compared to the same quarter in 2019. Also, note that this round is limited to a maximum of $2 million.

The relief bill provides a simplified forgiveness process for loans that are less than $150,000, expands the list of non-payroll expenses that can be covered by PPP loans, and clarifies what deductions for costs paid via PPP loans.

The bill also expands the Coronavirus Aid, Relief, and Economic Security (CARES) Act Employee Retention Tax Credit and extends it through June 30, 2021. Among the expansions are a credit rate increase from 50 to 70 percent of qualified wages and a creditable wage limit increase from $10,000 for the year to $10,000 for each quarter for each employee. The bill also increases the number of employees counted from 100 to 500 when determining the relevant qualified wage base. In addition, more companies will be eligible for ERTC since the bill reduces the year-over-year gross receipt decline requirement from 50 to 20 percent. Employers who receive PPP loans may also qualify for the ERTC if they need assistance with paying wages not covered by the PPP loans.

For companies honoring the required COVID-related paid family and sick leave established in the Families First Coronavirus Response Act, the bill extends refundable payroll tax credits through March 31, 2021.

The bill provides more funds for the Small Business Administration Economic Injury Disaster Loan program. The EIDLs offer an interest rate of 3.75 percent for small businesses, an automatic one-year deferment before monthly payments start, and a 30-year maturity. The SBA has extended the COVID-19 pandemic EIDL application to December 31.

This past year was challenging for many companies, so take advantage of all the tax credits and other programs for which you qualify.

.

Workforce Provisions

Recognizing the struggles that workers have faced during the COVID-19 pandemic, the bill restores the federal supplement to state unemployment benefits. This provision covers payments after December 6, 2020 through March 14, 2021; however, it reduces the supplement from $600 to $300 per week.

In an effort to help workers reenter the labor force, the bill adds $52 million to the existing Career and Technical Education state grants. It also includes amendments to the H-2B seasonal worker visa program, which will allow the Department of Homeland Security to raise the yearly 66,000 visa cap for fiscal year 2021.

Energy-Efficiency Tax Incentives

The bill gives a boost to renewable energy and energy-efficiency initiatives. The Residential Solar Tax Credit now extends to January 1, 2023, while the Business Solar Energy Property Credit extends to January 1, 2024.

Meanwhile, the Residential Energy-Efficiency Tax Credit, which was due to expire on December 31, 2020, extends another year to December 31, 2021. The Energy Efficient Homes Credit also extends to December 31, 2021. And the Energy Efficient Commercial Building Deduction has been adjusted for inflation and is now permanent.

Other Business Provisions

Businesses of all sizes also see benefits from the new bill. For instance, 501(c)(6) associations that meet specific criteria can now qualify for PPP loans. And the tax deduction for business meals is temporarily increased to 100 percent instead of the current 50 percent. This new deduction is limited to meals provided by a restaurant and expenses incurred after December 31, 2020; it expires at the end of 2022.

Make sure you understand all the benefits that the Consolidated Appropriations Act is providing for your business. This past year was challenging for many companies, so take advantage of all the tax credits and other programs for which you qualify.

Disclaimer: The information contained in this article is for general educational information only. This information does not constitute legal advice, is not intended to constitute legal advice, nor should it be relied upon as legal advice for your specific factual pattern or situation.

Coronavirus Image Credits:

AltoClassic / iStock / Getty Images Plus via Getty Images.

aprott / iStock / Getty Images Plus via Getty Images.

Trent Cotney, CEO of Cotney Construction Law, is a well-known advisor and legal counsel in the construction industry. With 14 offices across the United States, Cotney Construction Law is dedicated to representing and fighting for the industry nationwide. For more information, please visit cotneycl.com or call (866) 303-5868.

Brian Lambert is a partner at Cotney Attorneys & Consultants and is board certified in Construction Law by the Florida Bar and devotes his practice to all facets of construction. He is also a Florida Lobbyist and leads the firm’s Government Affairs practice group. Lambert has counseled clients on a host of issues involving virtually every aspect of the industry, including contract drafting, payment disputes, project delays, schedule acceleration, construction defects, and differing site conditions.