State of the

INDUSTRY

Study

The wall and ceiling industry has some great things going for it yet some major challenges.

By John Wyatt

State of the

INDUSTRY

Study

The wall and ceiling industry has some great things going for it yet some major challenges.

By John Wyatt

The wall and ceiling industry has some great things going for it yet some major challenges. By John Wyatt

W&C’s State of the Industry Study

Where are we at in the industry? Are things better than they were 10 or five years ago? Is labor still a challenge? What is the industry to do about the supply chain shortage? What are the latest concerns contractors/manufacturers/distributors have today?

The purpose of the Walls & Ceilings State of the Industry Study is to identify current business conditions, trends and issues in the wall and ceiling industry.

Specifically, this research seeks to identify:

- Influential factors and key challenges facing the industry

- Change in product sales for 2021 and into 2022

- Company information including number of employees and gross annual 2021 sales

- Demographic profile of wall and ceiling industry professionals

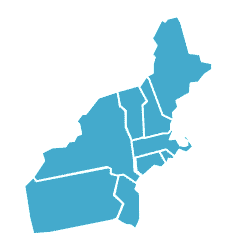

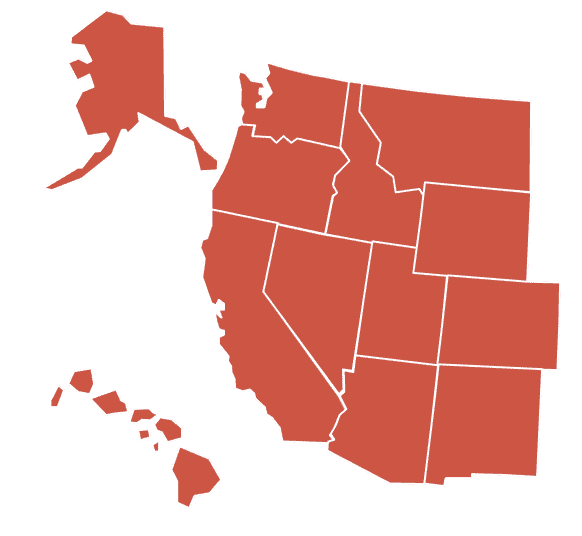

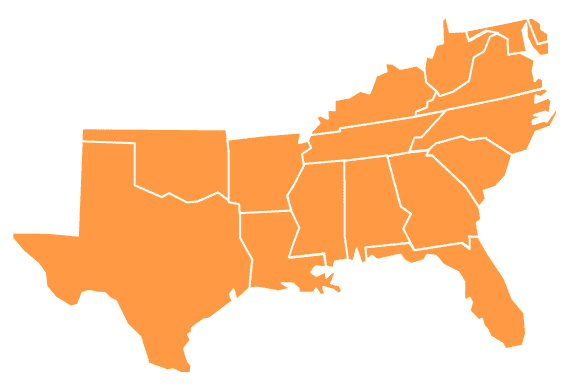

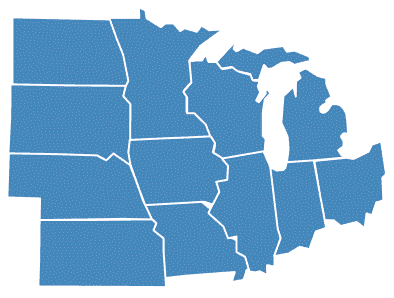

Out of those surveyed, 68 percent are subcontractors: 24 percent architects, 2 percent distributors and 7 percent "others." Regionally, the survey was divided up into four regions: the West (including Alaska and Hawaii), South, Midwest and Northeast.

Overall Business Conditions

Over half of respondents indicate business conditions are better in 2022 than in 2021, and three-in-five expect business conditions to be about the same or slightly worse in 2023.

Almost all respondents indicate the cost of doing business has increased in 2022 compared to 2021, and over four-in-five expect the cost of doing business to increase in 2023.

The majority of respondents indicate material costs and shortages as major issues for their business in 2023. Respondents’ companies are also facing labor availability issues, current economy/inflation challenges, and labor cost issues. As you can see, supply chain issues, cost inflations and labor are at the top of the heap.

Sales

Nearly three-in-five companies expect 2022 sales to increase compared to 2021, with an average expected increase of 19 percent.

Almost all respondents indicated an increase in material pricing over the past 12 months.

Employee Information

On average, responding companies have a median of 10 full-time employees and 1 part-time employee. Two-fifths of companies do not have part-time employees.

More than one-third of companies have increased current employee duties/responsibilities, gave out referral bonuses, and/or sought out new employees via job boards to help correct the shortage. In order to attract younger generations, respondents indicate they are offering competitive wages/benefits, providing training/mentoring, offering flexible work hours/ability to work remotely, and recruiting at schools/job fairs.

Industry Opinions and Actions

Material costs, economic conditions, supply chain and finding qualified workers are expected to be the most influential factors in 2023.

Labor issues are most likely to be the greatest challenge for companies within the wall and ceiling industry in 2023. Respondents suggest focusing on ways to retain employees/pay fairly, education/training, and controlling costs to ensure businesses have a profitable and successful future. Prefabrication is a promising technology for the wall and ceiling industry.

Region Surveyed

West

25%

Midwest

30%

Northeast

16%

South

29%

Most Promising Technology/Development

When those surveyed were asked what products/technology were considered to be on their radar, many supplied written responses. Among those that were referenced are:

- Prefabrication

- BIM

- Automation/Machine learning investing

- Robots

- Sustainability/Recycled materials

- Project management software

- Laser technology

- Estimation software

- 3-D scanning

- Integrated wall panels

- CAD software

- Lightweight materials

- Field technology